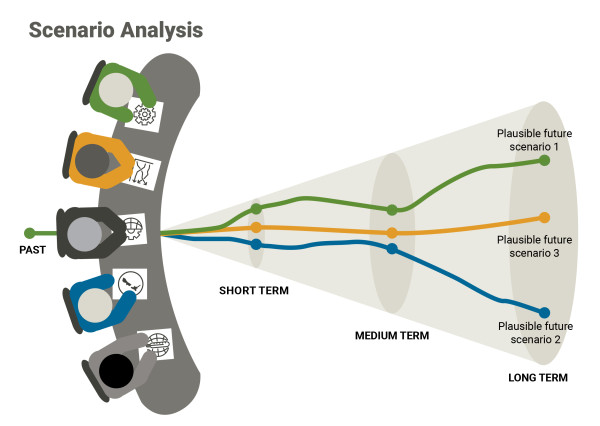

Undergoing a scenario analysis is to an organisation what a wind tunnel is to a plane: This is about exploring how it could behave under challenging but plausible conditions it may face and how the aircraft can be improved.

The purpose of scenario analysis under NZ CS 1 is to help entities to explore the climate-related risks and opportunities they may face and the resilience of their business model and strategy.

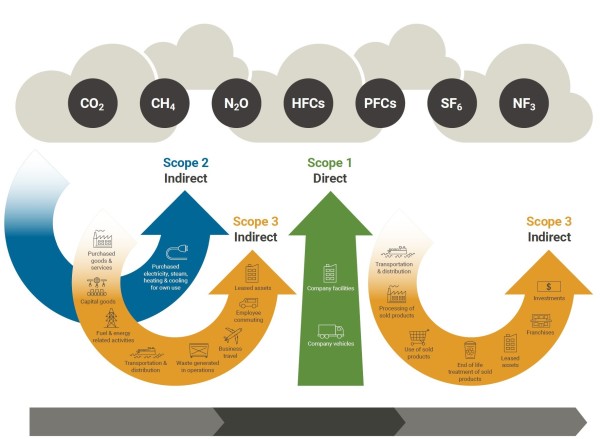

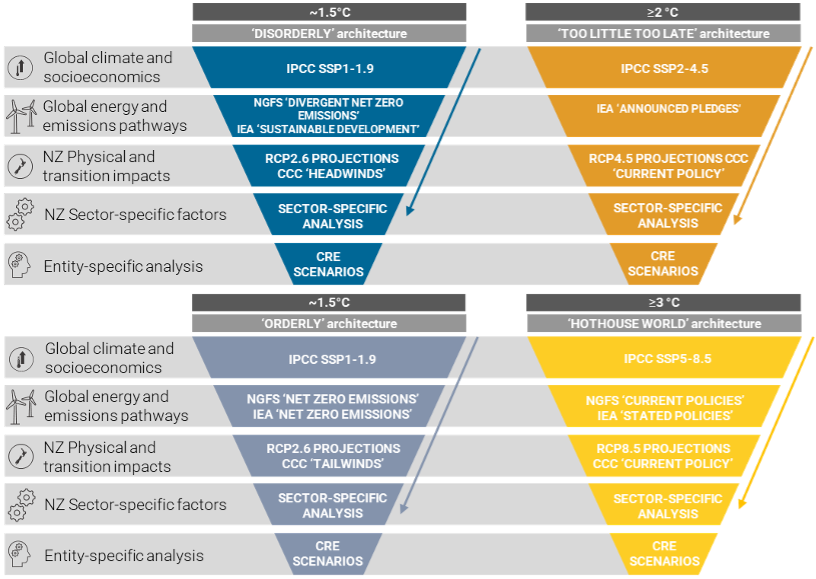

This exploratory analysis must include, at a minimum, a 1.5°C climate-related scenario, a 3°C or greater climate-related scenario, and a third climate-related scenario. These scenarios should integrate elements of physical and transition risk and opportunity.

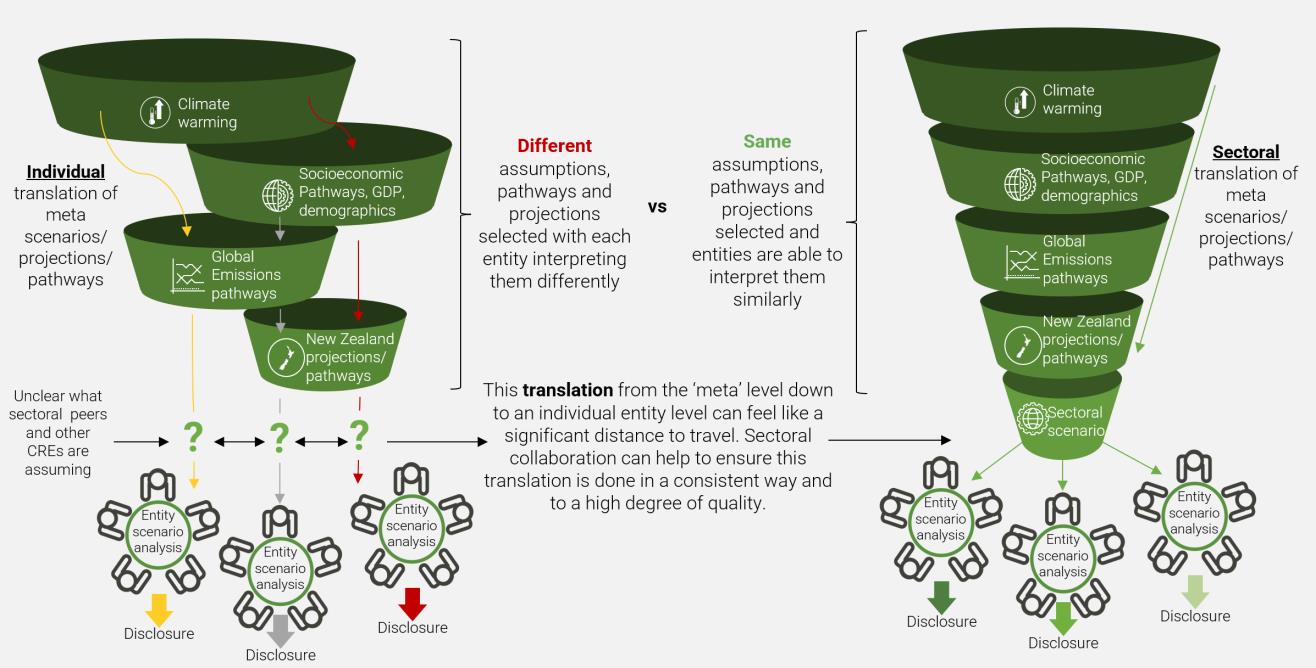

Entities are required to undertake their own scenario analysis at entity level as part of NZ CS 1, not sector level scenario analysis. However, sector specific scenarios will facilitate this process and reduce the overall resource required to undertake the analysis and will allow entities to focus on its specific risks and opportunities, business model and strategy.

The TCFD has published comprehensive guidance on the use of scenario analysis in disclosing climate-related risks and opportunities. Further information is also available in the External Reporting Board’s Guidance for All Sectors.