Proposed accounting standard for transfer expenses – ED PBE IPSAS 48 Transfer Expenses

ED PBE IPSAS 48 Transfer Expenses

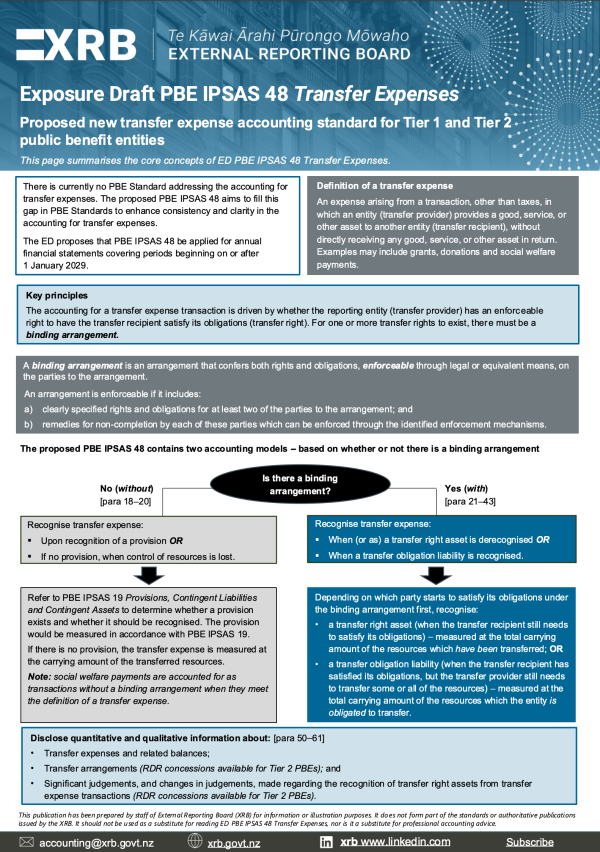

proposes accounting requirements for transfer expense transactions. There is currently no PBE Standard addressing these types of transactions. The proposed standard aims to fill this gap in PBE Standards to enhance consistency and clarity in the accounting for transfer expenses.

Consultation closed on 1 December 2025. Submissions received are listed on the main consultation page here.

What is a transfer expense?

|

A transfer expense is an expense arising from a transaction, other than taxes, in which an entity provides a good, service, or other asset to another entity, without directly receiving any good, service, or other asset in return. Examples of expenses that could meet this definition include grants and donations in cash or other assets, as well as social welfare payments. |

About ED PBE IPSAS 48 Transfer Expenses

|

ED PBE IPSAS 48 contains two models for transfer expense accounting, based on whether a binding arrangement exists. The proposed new standard provides focused guidance to help entities apply the principles to account for PBE transfer expense transactions. The ED proposes that PBE IPSAS 48 Transfer Expenses be applied for annual financial statements covering periods beginning on or after 1 January 2029. |

Our exposure draft and accompanying consultation document detail the proposals.

|

View our proposals for new revenue accounting here.

Educational guidance and support

One of the key benefits of this ED is the inclusion of clear guidance, supported by 11 illustrative examples, aimed at enhancing consistency in accounting for transfer expenses transactions.

Our one-page fact sheet and webcasts summarise the proposals in the ED.

|

|

Events

- Need to Know - Accounting update for Tier 1 and Tier 2 public sector entities. You can view the recording here and download the event slides here.

- Need to Know - Accounting update for Tier 1 and Tier 2 not-for-profit entities. You can view the recording here and download the event slides here.

-

Accounting standards open for consultation

-

Amendments to the Fair Value Option for Investments in Associates and Joint Ventures - Proposed amendments to IAS 28

-

Risk Mitigation Accounting - Proposed amendments to IFRS 9 and IFRS 7

-

IPSASB 2025 Work Programme Consultation

-

Closed for comment

-

Linkages Between IPSAS Standards and the Government Finance Statistics Manual 2014

-

- Auditing and assurance standards open for consultation

- Climate standards open for consultation